Picture this: you’re a sole trader, business humming along nicely, when suddenly you hit that magical £90,000 threshold. Your heart does a little skip – not from joy, but from the dawning realisation that sole trader VAT registration looms ahead like a particularly unwelcome relative at Christmas dinner.

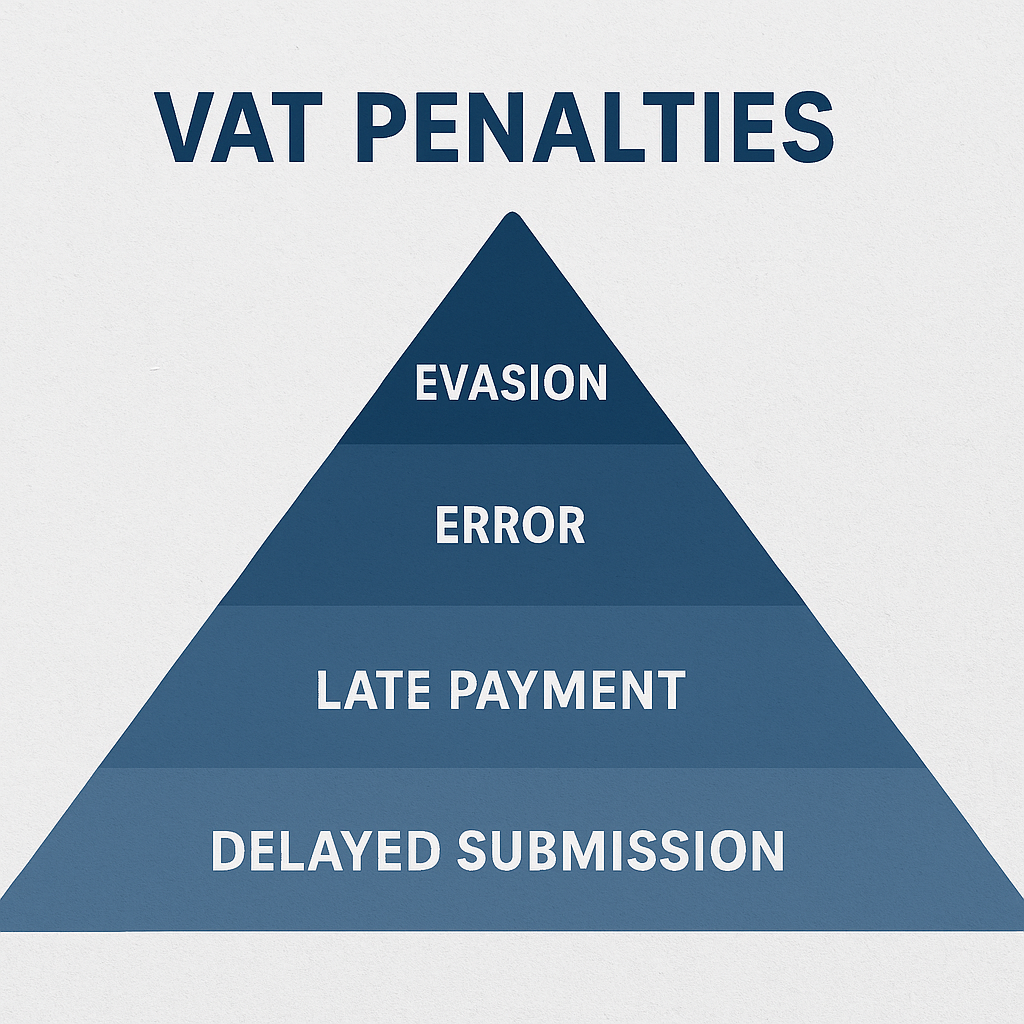

Here’s the thing most business owners don’t realise until it’s too late: sole trader VAT registration isn’t just about ticking boxes and filling forms. It’s about navigating a labyrinth of regulations where one wrong turn can lead to penalties that’ll make your quarterly tax bill look like pocket change.

I’ve seen countless sole traders attempt the DIY route with their VAT registration, convinced they can handle it themselves. Some succeed. Many don’t. The ones who struggle aren’t necessarily less intelligent – they’re just learning that HMRC doesn’t hand out participation trophies for effort when it comes to sole trader VAT registration.

The irony? Most sole traders spend more time researching their next laptop purchase than they do understanding VAT registration requirements. That £1,200 MacBook gets hours of consideration, but a process that could trigger thousands in penalties? “I’ll figure it out as I go along.”

The Registration Maze: It’s Not as Simple as It Looks

The 30-day rule sounds straightforward enough. You exceed £90,000 in taxable turnover, you register within 30 days. Simple? Not quite.

The complications start with understanding what counts as “taxable turnover.” Does that include the VAT-exempt services you provide? What about goods you export? The devil, as they say, lurks in the details – and he’s particularly fond of sole traders who wing their VAT registration.

Then there’s the question of when exactly you crossed the threshold. Was it when you invoiced the client or when they paid? For sole traders using cash accounting, this distinction matters enormously for your VAT registration. Get it wrong, and you’re looking at late registration penalties that start at £400 and escalate faster than a toddler’s tantrum.

Historic registration adds another layer of complexity to sole trader VAT registration. Some sole traders discover they should have registered months ago. The penalty structure here is particularly brutal – 5% of the net VAT due for each complete month you’re late, capped at 100% of the net VAT. That’s not a typo.

Consider Sarah, a freelance graphic designer who discovered in October that her rolling 12-month turnover had exceeded £90,000 back in July. Three months late meant a 15% penalty on top of the VAT she owed. Her “I’ll sort it out later” approach cost her £2,400 in penalties alone.

The threshold creep catches many sole traders off-guard. You might think you’re safely under £90,000, but HMRC’s calculation includes zero-rated supplies. Export goods? They count. Sell books or children’s clothes? They count too. Many sole traders get a nasty shock when they realise their “VAT-free” sales have pushed them over the threshold.

The Paperwork Purgatory

VAT registration forms aren’t exactly bedtime reading. Form VAT1 runs to multiple pages of questions that seem designed to test your patience rather than your business acumen.

Consider this seemingly innocent question: “Are you claiming input tax on goods and services bought for business use before registration?” Sounds simple. It’s not. The rules around pre-registration input tax recovery are so specific that even experienced accountants sometimes scratch their heads during sole trader VAT registration.

| Registration Scenario | Time Limit | Penalty if Late | Additional Considerations |

| Exceeded £90,000 threshold | 30 days | £400 minimum | Plus interest on VAT due |

| Voluntary registration | No penalty | N/A | Can register at any time |

| Historic registration | Immediate | 5% per month | Backdated to crossing point |

| Group registration | 30 days | £400 minimum | All companies jointly liable |

| Note: Penalties can be much higher depending on circumstances and amount of VAT owed | |||

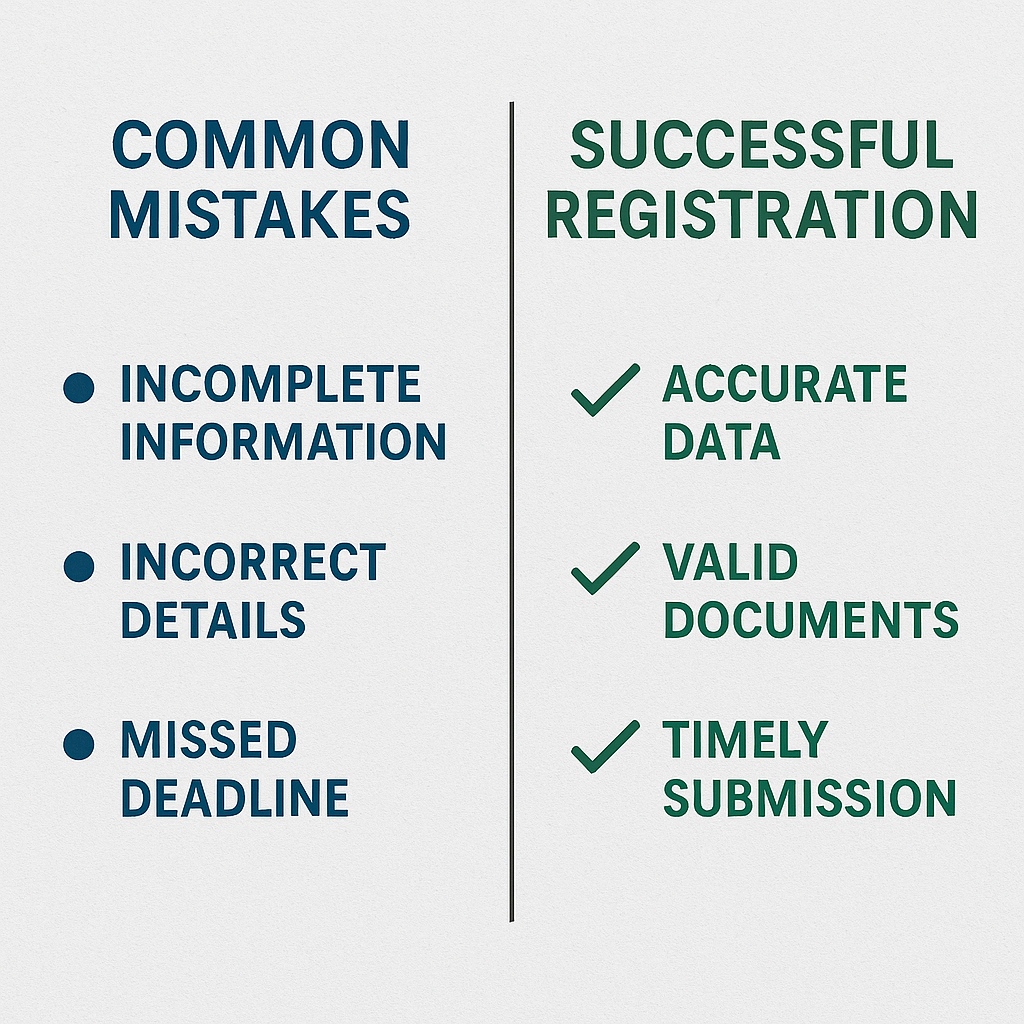

The evidence trap catches many sole traders off-guard during their VAT registration. HMRC expects you to maintain detailed records proving your registration timeline. Bank statements, invoices, delivery notes – they want it all. Missing documentation doesn’t just slow down your sole trader VAT registration; it can trigger investigations that nobody wants.

The business description minefield deserves special mention. HMRC uses your business description to determine which sector you operate in, which affects everything from your VAT scheme eligibility to your audit risk profile. Describe yourself as a “consultant” and you might find yourself in a different risk category than if you’d written “management adviser.” The difference could mean the difference between annual compliance checks and detailed quarterly scrutiny.

Common Mistakes That Cost Real Money

Mistake #1: Assuming all sales count equally Not all turnover is created equal for VAT purposes. Zero-rated supplies count towards the £90,000 threshold, but exempt supplies don’t. The difference? It could mean the difference between voluntary sole trader VAT registration and mandatory registration with penalties.

Take Mark, who runs a driving school. His driving lessons are exempt from VAT, but his online theory test courses are standard-rated. He assumed his exempt income didn’t count towards the threshold – wrong. Only his theory course income counted, but he’d miscalculated when he’d cross £90,000 of taxable supplies.

Mistake #2: Ignoring the 12-month rolling calculation The £90,000 threshold isn’t about your financial year – it’s about any rolling 12-month period. Some sole traders hit the threshold in month 8 of their financial year and assume they’re safe until the next year. They’re not – and their VAT registration becomes overdue.

Mistake #3: Misunderstanding the “business use” test Pre-registration input tax recovery sounds appealing, but HMRC’s definition of “business use” is narrower than many expect. Personal use, even if it’s just 5% of the time, can disqualify the entire claim during sole trader VAT registration.

Mistake #4: Choosing the wrong VAT scheme Standard VAT accounting isn’t your only option. The Flat Rate Scheme, Cash Accounting Scheme, and Annual Accounting Scheme each have different rules and benefits. Choose wrong, and you could be paying more VAT than necessary or facing cash flow challenges.

Mistake #5: Forgetting about the distance selling rules Sell goods to consumers in other EU countries? Different rules apply. Many sole traders discover too late that their Etsy shop or Amazon sales have created VAT obligations in multiple countries.

The Professional Advantage: Why Expert Help Pays for Itself

Professional accountants don’t just fill in forms – they navigate the system with the kind of insider knowledge that comes from dealing with HMRC regularly. They know which questions trigger additional scrutiny, which documentation HMRC prioritises, and crucially, how to present your case in the most favourable light for sole trader VAT registration.

Ask Accountant, based on Merton High Street, has seen every permutation of sole trader VAT registration imaginable. Their business accounting services extend beyond simple form-filling to strategic advice that can save thousands in penalties and administrative headaches.

The strategic element is what separates professional support from DIY attempts. Should you register voluntarily before hitting the £90,000 threshold? Sometimes yes, sometimes no. The decision depends on your client base, cash flow patterns, and growth projections. Get it wrong, and you’re either paying VAT unnecessarily or facing penalty charges for late sole trader VAT registration.

Scheme selection expertise can save thousands annually. A retail business might benefit from the Flat Rate Scheme, while a consultancy might prefer standard VAT accounting. The wrong choice can cost 2-3% of your turnover every year.

Professional advisers also understand the interconnections between different taxes. Your VAT registration affects your Corporation Tax position, your National Insurance contributions, and even your eligibility for certain business reliefs. DIY registration might sort your immediate VAT problem but create issues elsewhere.

Technology Troubles: When Digital Goes Wrong

HMRC’s digital-first approach sounds modern and efficient. In practice, it’s a system that seems designed by people who’ve never actually run a business. The online portal crashes at inconvenient moments, error messages provide all the clarity of a politician’s promise, and the help function is about as useful as a chocolate teapot.

Two-factor authentication adds another layer of complexity. Lose access to your phone, and you’re locked out of your own registration. I’ve seen sole traders miss deadlines because they couldn’t reset their security settings in time for their VAT registration.

The Government Gateway system deserves special mention for its ability to lose information at crucial moments. You spend hours entering data, hit submit, and… nothing. No confirmation, no error message, just digital silence. Professional advisers know the workarounds, the backup systems, and crucially, how to prove you attempted registration even when technology fails.

Browser compatibility issues affect different users differently. What works on Chrome might fail on Safari. Internet Explorer? Forget about it. The system seems to have been designed for a single browser configuration, and woe betide anyone using anything else.

Mobile unfriendly design means you’re essentially tied to a desktop computer for registration. Try completing Form VAT1 on your phone and you’ll understand why professional support becomes attractive.

The Hidden Costs of Going It Alone

Beyond the obvious penalty risks, DIY sole trader VAT registration carries hidden costs that many sole traders don’t consider:

- Time investment: The average sole trader spends 15-20 hours researching, completing, and following up on their VAT registration. At £50 per hour (a conservative estimate of your time value), that’s £750-£1,000 in opportunity cost.

- Stress and uncertainty: Nothing quite matches the anxiety of wondering whether you’ve completed your sole trader VAT registration correctly. Sleep is valuable, and peace of mind has a price.

- Ongoing compliance: Registration is just the beginning. Quarterly returns, annual reviews, and record-keeping requirements continue indefinitely. Professional support ensures you start with solid foundations.

- Opportunity cost: While you’re wrestling with VAT forms, you’re not serving customers, developing products, or growing your business. The revenue you don’t earn while dealing with registration paperwork can exceed the cost of professional help.

- Mistakes that compound: Get your registration wrong, and the problems multiply. Wrong VAT scheme choice affects every subsequent return. Incorrect business classification might trigger unnecessary inspections. Missing the optimal registration date can affect your cash flow for years.

Making the Smart Choice

| DIY Registration | Professional Support |

| High penalty risk | Penalty protection |

| Time-consuming | Efficient process |

| Stressful | Peace of mind |

| Learning curve | Expert knowledge |

| Ongoing uncertainty | Continued support |

| Single-point failure | Backup systems |

The maths is surprisingly straightforward. Professional VAT registration support typically costs £200-£500. A single late registration penalty starts at £400 and escalates rapidly. The choice becomes obvious when you factor in the time savings and reduced stress.

Ask Accountant’s approach goes beyond simple registration. Their tax advisory solutions include strategic planning that can optimise your VAT position from day one. Whether you’re dealing with inheritance tax complications or need comprehensive business advice, their team understands how different aspects of taxation interact.

Their proactive tax advisory solutions mean you don’t just get registered – you get registered optimally. The right scheme, the right timing, and the right ongoing support to ensure compliance becomes routine rather than stressful.

The Bottom Line: Protection vs. Penny-Pinching

Sole trader VAT registration isn’t a place to cut corners. The penalties are real, the deadlines are firm, and HMRC’s sympathy is limited. Professional support isn’t an expense – it’s insurance against costly mistakes.

When you’re ready to take the stress out of sole trader VAT registration, Ask Accountant offers comprehensive support that covers everything from initial registration through ongoing compliance. Their team at 178 Merton High Street can be reached on 020 8543 1991 for a consultation that could save you thousands in penalties and countless hours of frustration.

The choice is yours: roll the dice with DIY registration or invest in professional support that protects your business and your sanity. In my experience, the smartest sole traders choose protection every time.

Remember, your business success depends on focusing on what you do best – running your business. Let the VAT experts handle the registration complexity while you concentrate on serving your customers and growing your profits. It’s not just about avoiding penalties; it’s about optimising your entire tax position for long-term success.

Common Questions Asked

Q: Is it possible to register to VAT prior to when I will require it?

A: Yes, you can register voluntarily and occasionally to your advantage especially when you are dealing with VAT registered customers who can reclaim VAT you have increased on them.

Q: What will occur in case I forget to spend within the 30 days?

A: Penalties on late registration are calculated on minimum of 400 and the later you are, and the more VAT you owe the higher they are. In the worst cases, the penalty may amount to 100 percent of the VAT payable.

Q: Am I required to register when I sell, in the case of consumers, only?

A: once you pass the limit of 90,000 pound, you must be registered irrespective of the number of your customers. Nevertheless, voluntary registration may not remain appealing in case of selling to consumers.

Q: Can I cancel the registration in case my turnover is reduced?

A: Yes, you can deregister when the turnover is below 88, 000 pounds but there are requirements and steps that should be taken. And any stock you hold should also take into consideration VAT.

Q: What will be my records?

A: Your business must have detailed documentation on all its transactions, that is, sales invoices, purchase receipts, bank statements and VAT calculation. They have to be retained at least six years.

Q: How fast will HMRC take in my registration?

A: Processing: standard 2-3 weeks, but dreadful cases might take an extended period. Ahead of time will provide you with slack days in case some problems occur.