Stop losing sleep over your books. See how outsourced bookkeeping can help your London startup grow.

Introduction: The Money Struggles of London Startups

Picture this: It’s late Tuesday night. Instead of planning your next business move or getting some rest, you’re staring at spreadsheets, trying to figure out your finances. Sounds familiar? For most London startup owners, it does.

London’s startup scene is booming, with new companies popping up all the time. But success comes with challenges – especially when it comes to managing money. Many founders end up doing their own bookkeeping, feeling more like amateur accountants than business leaders.

What if there’s a better way? A way that lets you focus on growing your business while someone else handles your books? That’s what outsourced bookkeeping offers.

Why London Startups Need Special Bookkeeping Help

Running a business in London isn’t easy. The city’s tough market, strict rules, and high costs mean startups must be smart with money from day one. Getting expert business advice is crucial.

For any London startup, keeping good financial records isn’t just nice to have – it’s a must for survival. But let’s be honest: most founders didn’t start their businesses because they love tracking expenses or filing tax forms. Explore our business start-ups and registrations service for help.

“A startup’s most valuable resource isn’t money – it’s time. Outsourcing bookkeeping gives founders back hours they need to actually grow their business.”

The Clear Benefits of Outsourcing Bookkeeping for London Startups

Time: Your Most Valuable Asset

You can’t make more time. In London’s fast-moving business world, every hour counts. Here’s what outsourcing your bookkeeping saves you:

- No more late nights with spreadsheets: Most founders spend 5-10 hours weekly on bookkeeping – that’s up to 40 hours monthly you could use for growing your business.

- Faster financial updates: Professional bookkeepers can create reports much quicker than you can.

- Less to learn: No need to master complex accounting software or keep up with changing tax rules. Our tax compliance experts can handle this.

(Note: The reference to Maya, a fintech founder in Shoreditch, is illustrative. A known fintech founder named Maya Nijhawan is based in New York, not Shoreditch, according to available information [1].)

Money Savings That Add Up

Surprisingly, outsourcing bookkeeping often costs less than doing it in-house. Here’s how the numbers typically look for London startups:

| Expense | In-House Bookkeeping | Outsourced Bookkeeping |

|---|---|---|

| Staff | £25,000-£35,000/year (part-time bookkeeper) | £200-£1,000/month (based on service level) |

| Software | £300-£600/year | Often included |

| Training | £500-£1,500/year | £0 |

| Mistakes & Wasted Time | Potentially high | Reduced by expertise |

When you factor in the hidden costs of DIY bookkeeping – mistakes, wasted time, and what you could be doing instead – outsourcing starts to look like a smart choice.

Expert Help Without Hiring Full-Time

London’s financial rules are complex and always changing. Brexit has added new challenges, and staying compliant with HMRC requires special knowledge. We can assist with dealing with HMRC investigations.

Outsourced bookkeeping services hire professionals who:

- Keep up with UK tax laws and rules, including corporate tax planning and personal tax planning.

- Understand London’s business environment.

- Have worked with startups in different industries.

- Know how to improve your financial processes.

This expertise would cost a lot to have in-house but becomes affordable through an outsourced service like ours at Ask Accountants UK Ltd.

What Bookkeeping Tasks Can London Startups Outsource?

You might wonder exactly what bookkeeping jobs you can hand over. The answer: almost everything.

Daily Money Management

- Bank reconciliations

- Tracking money coming in and going out

- Sorting expenses by category

- Creating and sending invoices

- Processing payroll

Financial Reports and Analysis

- Monthly financial statements (Accounts and Tax)

- Cash flow forecasts

- Budget tracking

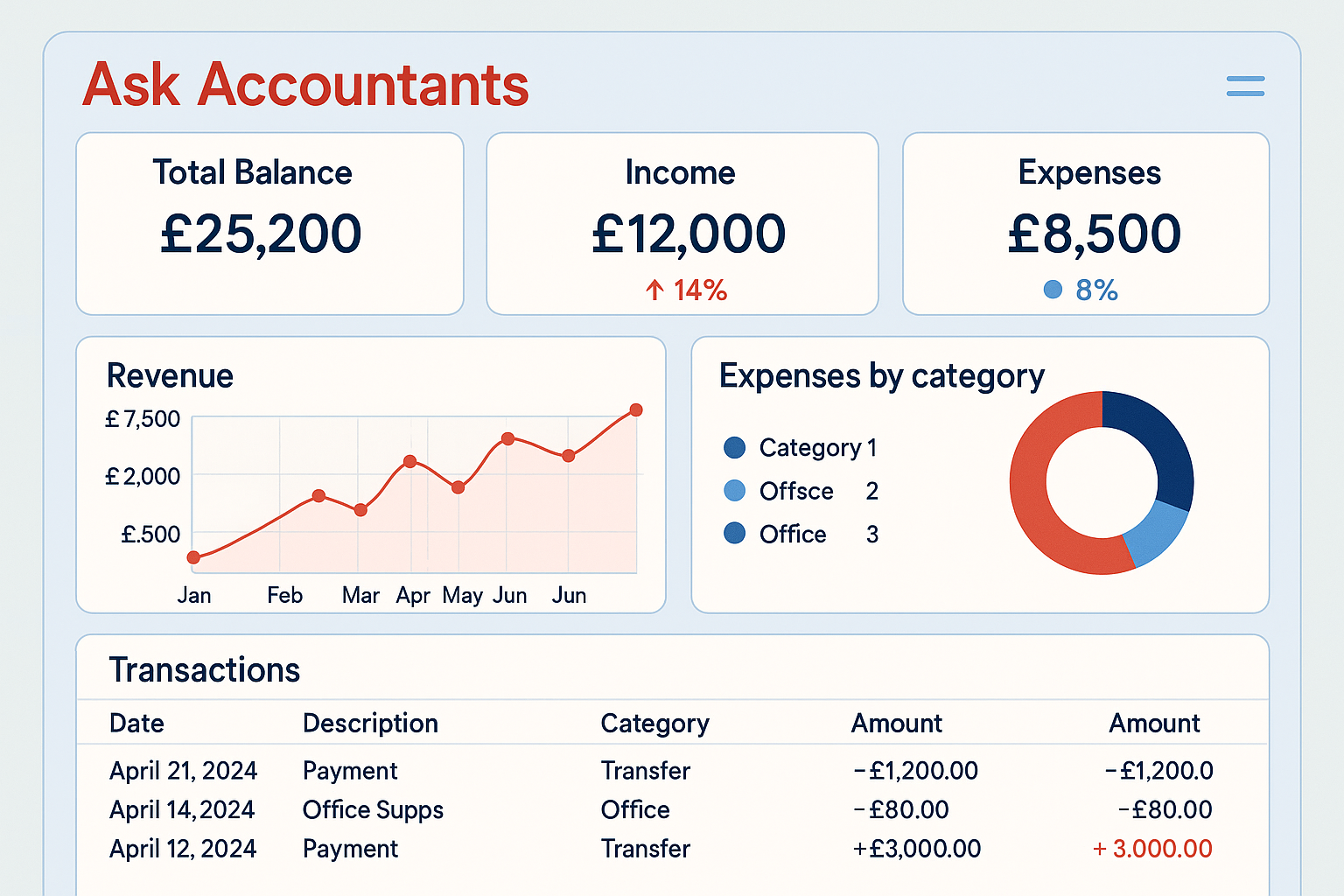

- Real-time financial dashboards (via Cloud Accounting)

- Reports for investors

Tax and Compliance

- VAT returns

- PAYE and National Insurance (Automatic Enrolment Services)

- Year-end accounts

- Tax filing help (Self Assessment)

- Companies House filings

Security and Compliance: Addressing Your Biggest Concern

“But is it safe to let someone else handle my money information?” It’s a fair question that deserves a straight answer.

Good outsourced bookkeeping services for London startups use strong security measures, often better than what small businesses can set up on their own:

- Bank-level encryption for all financial data

- Two-factor authentication to access your accounts

- Regular security checks and compliance reviews

- Strict data protection policies that follow UK GDPR rules (See our Privacy Policy)

- Professional insurance to cover any possible issues

Most established bookkeeping services in London follow best practices recommended by groups like the Institute of Certified Bookkeepers (ICB) and the Association of Chartered Certified Accountants (ACCA). Learn more about what makes a great chartered accountant.

Choosing the Right Bookkeeping Service in London

Not all bookkeeping services are the same. For London startups, finding the right partner matters a lot. Here’s what to look for:

Startup Experience

Does the provider understand startup challenges? Have they worked with businesses like yours? A bookkeeper who works with big retail chains might not be right for your tech startup. We specialize in business start-ups.

Technology

The best bookkeeping partners use modern, cloud-based tools that work with software London startups typically use, like Xero, QuickBooks, Sage, or FreeAgent. Ask what tech they use and how it will connect with your systems.

Room to Grow

Your startup will hopefully grow quickly. Can your bookkeeping service grow with you? Look for providers with different service levels that can change as your needs become more complex.

London Knowledge

While remote bookkeeping works well, having a service provider who knows London’s business scene offers benefits – especially for handling local rules and finding area-specific opportunities. Read our thoughts on finding local expertise in London.

Communication Style

Do you want weekly updates or minimal contact? Some founders prefer hands-off relationships, while others want regular check-ins. Find a provider whose communication style matches what you want. Contact us to discuss your preferences.

Real-Time Updates: A Big Advantage for London Startups

One of the best benefits of modern outsourced bookkeeping is seeing your finances in real time. Gone are the days when outsourcing meant waiting weeks for updates on your money situation.

Today’s cloud-based bookkeeping services give London startups:

- Up-to-date financial data you can access from anywhere

- Custom dashboards showing key numbers and trends

- Instant expense sorting using smart technology

- Mobile apps for checking finances on the go

- Automatic alerts for cash flow issues or unusual transactions

This real-time insight helps startups in London’s fast-moving business world, where quick decisions based on accurate money data can make or break your success.

The Cost Question: What You’ll Pay

The cost of outsourcing bookkeeping for London startups varies based on:

- How many transactions you have

- How complex your business is

- What services you need

- How often you want reports

For new London startups, basic bookkeeping services might start around £200-£300 monthly. As you grow and need more help, this can increase to £500-£1,000+ monthly.

While this might seem like a lot, compare it to the full cost of handling bookkeeping yourself:

- Salary and benefits for an in-house bookkeeper

- Accounting software costs

- Training and learning time

- Time you would spend overseeing everything

- Possible costs of mistakes or compliance problems

Switching to Outsourced Bookkeeping: What to Expect

Moving to outsourced bookkeeping is usually straightforward, but it does take some setup. Here’s what typically happens for London startups:

- First Meeting (1-2 days): Talk with the provider about your needs and set expectations. Get in touch.

- Setup Phase (1-2 weeks): Give access to financial accounts, set up software connections, and establish processes.

- Catch-up Time (varies): If your books aren’t up-to-date, there might be a period to get everything current. This could take a few days to several weeks, depending on your situation.

- Ongoing Work (continuous): Once everything is set up, daily bookkeeping tasks shift to your provider, with regular check-ins as agreed.

Many London startups report being fully switched over within a month, with minimal disruption to their business.

Common Concerns Answered

“Will I lose control over my finances?”

Actually, the opposite usually happens. Outsourced bookkeeping typically gives founders more control through better visibility and expert insights, without having to do all the work. You’ll still make all decisions while benefiting from organized, accurate financial information to guide those decisions.

“What happens if there are mistakes?”

Good bookkeeping services have quality checks to minimize errors. They also carry professional indemnity insurance to protect against mistakes. Professional bookkeeping services usually make far fewer errors than non-specialists or founder-led bookkeeping, especially in London’s complex business environment. Our team is dedicated to accuracy.

“How does outsourcing bookkeeping help my business grow?”

As your London startup grows, your bookkeeping needs will change. Outsourced services can easily scale up, adding services or increasing capacity without the hiring, training, and management challenges of building an in-house team. We offer consultancy and system advice to support growth. This flexibility is especially valuable in London’s competitive job market, where finding good finance staff can be hard and expensive.

The Bigger Picture: Strategic Benefits Beyond Daily Tasks

While the obvious benefits of outsourced bookkeeping are clear – time savings, cost efficiency, expertise – there are bigger strategic advantages that especially help London startups:

Ready for Investors

London’s investors expect perfect financial records when considering funding opportunities. Outsourced bookkeeping services can help prepare investor-ready financials that build confidence, potentially including business plans.

Growing Internationally

Many London startups want to go global. Professional bookkeeping services often have experience with international transactions, multiple currencies, and cross-border tax issues – knowledge that’s hard to develop in-house.

Business Insights

Modern bookkeeping isn’t just about recording transactions; it’s about spotting trends. Outsourced providers can help identify patterns, opportunities, and potential problems in your financial data that you might miss. Check our blog for insights.

Conclusion: A Smart Choice for London Startup Success

Outsourcing your bookkeeping isn’t just an admin decision – it’s a strategic choice that can greatly impact your London startup’s growth. By freeing up time, providing expertise, ensuring compliance, and delivering real-time financial insights, outsourced bookkeeping services help founders focus on what they do best: building great businesses. Read more about accounting for small businesses in London.

The London startup world is tough enough without getting stuck in financial paperwork. By partnering with the right bookkeeping service, you’re not just keeping good records – you’re giving yourself the freedom and information to make better business decisions.

Ready to change how your startup handles its finances? The first step is identifying what you need and finding a provider who understands London’s startup challenges. Learn more about Ask Accountants UK Ltd.