Here’s something nobody tells you when you start a business: the accounting bit will keep you up at night more than any dodgy client or failed pitch ever could.

I remember chatting with a mate who runs a small construction firm in Manchester. Brilliant at what he does – can build you a gorgeous extension that’ll make your neighbours weep with envy. But mention VAT thresholds or CIS deductions? The man goes pale. Last year, he nearly got slapped with a £1,200 penalty because he thought “Making Tax Digital” was just another government buzzword he could ignore. (Spoiler: it wasn’t.)

That’s the thing about small business accounting services in the UK – they’re not just about keeping your books tidy or filing returns on time. They’re about keeping you sane whilst HMRC constantly shifts the goalposts and your business tries to actually, you know, grow.

Why Your Spreadsheet Isn’t Cutting It Anymore

Look, I get it. When you’re bootstrapping a business, paying someone else to “just add up numbers” feels like a luxury you can’t afford. Excel is free (ish), you’ve got YouTube tutorials, and how hard can it really be?

Turns out? Properly hard.

The average small business owner in the UK spends roughly 120 hours per year on admin and accounting tasks. That’s three full working weeks you could spend winning new clients, developing products, or – radical thought – actually taking a holiday.

But beyond the time-suck, there’s the error factor. A misclassified expense here, a forgotten invoice there, and suddenly you’re either overpaying tax (ouch) or underpaying it (double ouch when HMRC comes knocking). The second scenario typically costs about 15-30% more than what you actually owed, once penalties and interest stack up.

What Actually Qualifies as “Good” Small Business Accounting Services?

This isn’t just about finding someone who can use a calculator. The best small business accounting services in the UK should feel less like hiring a bean-counter and more like gaining a business partner who actually understands what you’re trying to build.

The Non-Negotiables

Bookkeeping that doesn’t make you want to cry. Proper bookkeeping means every transaction gets recorded, categorised, and reconciled. Not “I’ll sort it out in March when my tax return is due” bookkeeping. We’re talking regular, systematic tracking that gives you a real-time view of your cash flow.

Modern bookkeeping services now integrate with your business bank account and automatically categorise most transactions. It’s not magic – though it feels like it compared to manual data entry.

Tax compliance without the panic attacks. Corporation Tax, Self Assessment, VAT returns, PAYE… the list goes on. Each one has different deadlines, different forms, and different ways to trip you up. A decent accountant handles all this whilst you sleep soundly (or at least, whilst you worry about normal business things rather than tax penalties).

Did you know that HMRC tax investigations have increased by 37% in the past three years? Having someone who knows what they’re doing isn’t paranoia – it’s prudence.

Actual advice when you need it. The difference between adequate and excellent small business accounting services often comes down to this: will your accountant proactively tell you about a tax-saving opportunity, or will they just file your returns and invoice you?

The Extras That Make the Difference

Payroll management that doesn’t require a degree in bureaucracy. If you’ve got employees (or even just yourself on the books), sorting out PAYE, National Insurance, pensions auto-enrolment, and all the associated paperwork is enough to make anyone question their life choices.

Professional payroll services handle this monthly nightmare so you don’t have to. They’ll even deal with Real Time Information submissions to HMRC, which is exactly as tedious as it sounds.

Growth planning and forecasting. This is where good accountants separate themselves from glorified number-crunchers. Can they look at your figures and tell you whether that new hire is affordable? Can they model what happens to your cash flow if you land that big contract? Can they explain it without drowning you in jargon?

When I spoke with the team at Ask Accountant (based in Merton, South West London), they mentioned something interesting: most small businesses don’t fail because of bad products or services – they fail because of poor financial planning. Cash flow forecasting, profit margin analysis, and strategic tax planning aren’t luxuries. They’re survival tools.

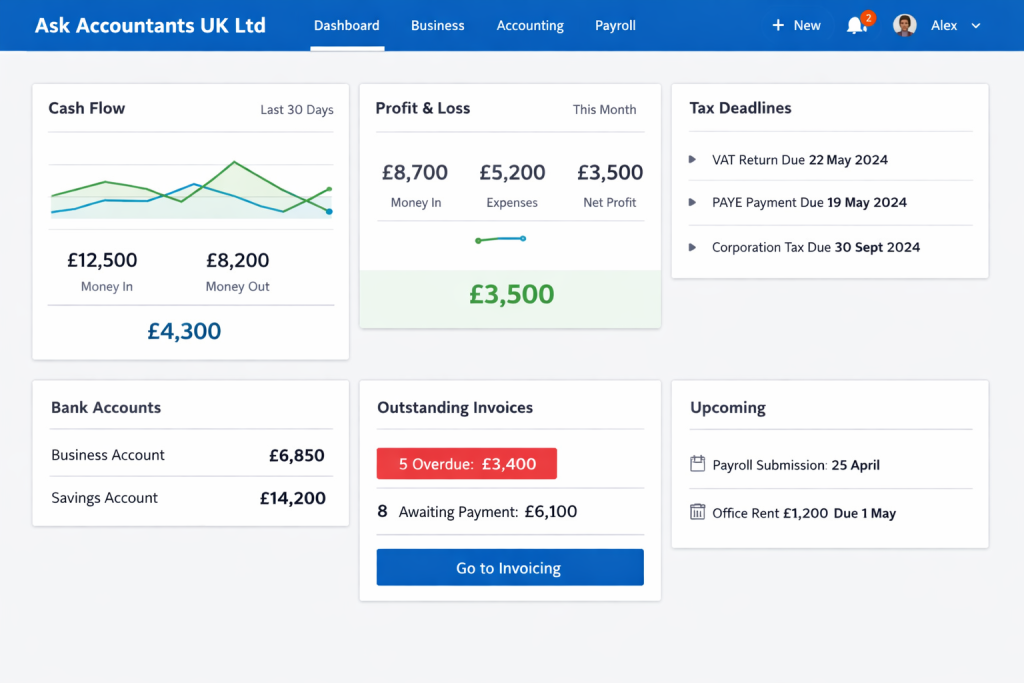

Cloud accounting setup. If your accountant is still working with paper receipts and desktop software that requires installation CDs (do those even exist anymore?), run. Modern small business accounting services use cloud-based platforms like Xero, QuickBooks, or Sage. This means you can check your finances from your phone whilst pretending to watch your kid’s school play.

The UK-Specific Complications Nobody Warns You About

Accounting in the UK has its own special flavour of complicated. Brexit mucked about with VAT rules for anyone trading with the EU. Making Tax Digital keeps expanding its reach. And don’t even get me started on the Construction Industry Scheme.

Making Tax Digital: The Gift That Keeps On Taking

MTD started with VAT-registered businesses but is creeping into Income Tax for sole traders and landlords. From April 2026, if your business income exceeds £50,000, you’ll need to keep digital records and submit updates quarterly through compatible software.

Miss the deadline or file incorrectly? Penalties start at £200 and escalate fast. Good cloud accounting support makes this compliance burden significantly less painful.

The CIS Mess (If You’re in Construction)

Anyone working in construction deals with the Construction Industry Scheme – a system where contractors deduct money from your payments and send it to HMRC on your behalf. In theory, it’s meant to prevent tax evasion. In practice, it’s a paperwork nightmare that creates cash flow headaches.

Specialist CIS claims and refunds support can help you reclaim overpaid deductions and ensure you’re registered correctly. Getting this wrong can mean waiting months (sometimes years) for refunds you’re legitimately owed.

What Small Business Accounting Services Actually Cost (And What You’re Paying For)

Right, the question everyone’s thinking: how much is this going to sting?

Truth is, pricing varies wildly depending on your business structure, complexity, and what services you actually need. Here’s a rough guide based on current UK market rates:

| Service Type | Typical Cost Range | What’s Included |

|---|---|---|

| Basic Bookkeeping | £75-£200/month | Transaction recording, bank reconciliation, basic reporting |

| Sole Trader Accounts | £300-£800/year | Annual accounts, Self Assessment tax return |

| Limited Company Package | £900-£2,500/year | Bookkeeping, year-end accounts, Corporation Tax, confirmation statement |

| VAT Returns | £150-£300/quarter | Quarterly VAT calculations and submissions |

| Payroll Services | £15-£40 per employee/month | Salary processing, PAYE, NI, RTI submissions, payslips |

| Tax Planning Consultation | £150-£500/session | Strategic tax advice, scenario planning, efficiency reviews |

These are ballpark figures. A simple sole trader with straightforward income might pay £600 annually. A limited company with employees, VAT, and multiple income streams? You’re looking at £2,000-£4,000+ per year.

But here’s the kicker: proper tax planning typically saves small businesses 2-3 times what they pay in accounting fees. Miss a capital allowance claim or muck up your dividend strategy, and you’re leaving thousands on the table.

DIY Accounting vs. Professional Services: The Honest Breakdown

Should you just learn to do it yourself? Maybe. Here’s when each approach makes sense:

DIY Makes Sense When:

- You’re a sole trader with simple, straightforward income (freelance writing, consultancy, etc.)

- Your annual turnover is under £20,000

- You genuinely enjoy admin and have time to learn the systems

- You’re not VAT-registered and don’t have employees

- You’re extremely organised and good with deadlines

Even then, I’d recommend getting professional help with your annual tax return. The tax code changes constantly, and one missed deduction can wipe out any savings from going solo.

Professional Services Become Essential When:

- You’re running a limited company (the compliance requirements alone justify the cost)

- You’ve hit the VAT threshold or chosen voluntary registration

- You’ve got employees on the books

- Your business has multiple income streams or complex expenses

- You work in construction (CIS) or property (rental income complications)

- You’re planning significant business changes (expansion, investment, sale)

Red Flags When Choosing Small Business Accounting Services

Not all accountants are created equal. Some warning signs to watch for:

They promise unrealistic tax savings. If someone’s guaranteeing they’ll slash your tax bill by 50%, they’re either planning something dodgy or wildly optimistic. Legitimate tax planning achieves real savings, but anyone making outlandish promises should raise eyebrows.

Communication is slower than a government website. If it takes a week to get a response to a simple question during non-busy season, imagine the frustration come January 31st. Responsive small business accounting services should reply within 24-48 hours for most queries.

They’re not qualified or registered. Anyone can call themselves an accountant in the UK – there’s no legal protection on the title. Look for proper credentials: ACCA, ICAEW, CIMA. Check they’re registered for anti-money laundering supervision (legally required if they’re handling your accounts).

Fixed fees turn into surprise bills. Transparent pricing matters. If the quote keeps expanding with “additional services” you didn’t ask for, that’s a problem. Good firms outline exactly what’s included and what costs extra.

The Ask Accountant Approach: Local Expertise That Actually Delivers

Since we’re talking about solid small business accounting services in the UK, it’s worth mentioning what genuinely good service looks like in practice.

Ask Accountant, operating from their Merton High Street office in South West London, takes a refreshingly practical approach to business accounting. Rather than drowning clients in accountant-speak, they focus on three core principles: clarity, proactive communication, and actual business growth support.

Their service range covers everything from basic bookkeeping and Self Assessment through to more specialised areas like CIS refund claims and inheritance tax planning. What stands out is their emphasis on proactive business advice – not just reactive number-crunching.

Located at 178 Merton High St, London SW19 1AY, they’re available on +44(0)20 8543 1991 for anyone who prefers an actual conversation over endless email chains. Sometimes, talking through your accounts with a human being beats deciphering another automated portal message.

Choosing the Right Accounting Structure for Your Business

Different business structures have wildly different accounting needs. Here’s what actually matters:

| Business Type | Key Accounting Requirements | Services You’ll Need |

|---|---|---|

| Sole Trader | Self Assessment, Income Tax, possibly Class 2 & 4 NI | Basic bookkeeping, annual accounts, tax return filing |

| Partnership | Partnership tax return, individual Self Assessments for partners | Partnership accounts, tax allocation, multiple tax returns |

| Limited Company | Corporation Tax, company accounts to Companies House, director’s tax returns, payroll if taking salary | Full bookkeeping, company accounts, CT600, confirmation statement, likely payroll, dividend planning |

| Freelance/Contractor | Depends on structure, often IR35 considerations | IR35 compliance review, contract vetting, tax-efficient structure advice, expense tracking |

If you’re operating as a limited company, the accounting requirements jump significantly. You’ll need proper company accounts prepared, filed with both HMRC and Companies House, and you’ll be dealing with Corporation Tax rather than Income Tax. This is where small business accounting services stop being optional and become necessary.

The Tech You’ll Actually Use (Or Should Be Using)

Modern accounting runs on software, not paper ledgers. The UK market is dominated by three main players:

Xero – Popular with small businesses and their accountants. Clean interface, solid mobile app, integrates with basically everything. Pricing starts around £14/month for basic plans.

QuickBooks – The American giant that’s massive in the UK. More features than you’ll probably ever use, but that’s not necessarily bad. Strong invoicing tools. Similar pricing to Xero.

Sage – The UK stalwart. Been around forever, which means it’s either reassuringly established or frustratingly old-fashioned, depending on your perspective. Starts at £18/month but payroll now included.

Most decent accountants work with all three. They’ll typically recommend one based on your specific needs. The right cloud accounting platform saves hours every month once you’re set up properly.

FreshBooks and Zoho Books are newer contenders gaining traction, particularly among freelancers and very small businesses. They’re simpler, cheaper, and sometimes that’s exactly what you need.

Beyond the Numbers: How Accounting Affects Growth

This is where small business accounting services transform from necessary evil into actual business advantage.

Cash Flow Forecasting That Actually Works

Knowing what’s coming in and going out isn’t just about avoiding overdraft fees. It’s about making smart decisions. Should you hire that new person? Can you afford to invest in equipment? Is it worth taking on a big project that pays in 90 days when you’ve got payroll to meet next month?

Without proper cash flow visibility, you’re basically driving blindfolded. Good accountants provide this clarity as standard, not as an expensive add-on.

Funding and Investment Preparation

Trying to get a business loan or attract investors with messy accounts is like turning up to a job interview in your pyjamas. Banks and investors want clean, professional financial statements that tell a clear story.

Professional business planning and well-maintained accounts significantly improve your chances of securing funding. The difference between “we’ll think about it” and “here’s the money” often comes down to financial presentation quality.

Exit Planning (Yes, Even If You Just Started)

Eventually, you might want to sell your business or pass it on. Businesses with clean, professional accounts sell for significantly more than those with chaotic records. We’re talking 20-30% valuation differences.

Start keeping proper records now, even if selling is decades away. Future you will be grateful. (And rich.)

Specific Scenarios Where Expert Help Saves Your Bacon

Let me share some real-world examples where professional small business accounting services made material differences:

The Contractor Who Didn’t Know About CIS Deductions

Jake, a self-employed electrician, had been having 20% deducted from his invoices for two years under CIS. He didn’t realise he could reclaim much of this through his tax return if his business expenses were high enough. Two years of overpayments totalled nearly £4,000. A specialist in CIS claims sorted it within three months.

The Online Seller Who Triggered a VAT Nightmare

Sarah ran a successful Etsy shop, hit £85,000 turnover, and didn’t register for VAT. By the time HMRC caught up with her, she owed backpayments plus penalties totalling £16,000. All preventable with basic accounting oversight.

The Limited Company Director Paying Too Much Tax

Mike had been paying himself entirely through salary, meaning he was paying significantly more tax and National Insurance than necessary. A proper dividend strategy restructure saved him £4,200 annually. That’s £4,200 every single year, indefinitely.

Warning Signs Your Business Needs an Accountant Yesterday

Certain situations demand immediate professional help:

- You’ve received a brown envelope from HMRC – Don’t panic, but do get help fast. Whether it’s an investigation notice or just a query about your tax return, professional representation matters.

- Your business turnover is approaching £85,000 – VAT registration isn’t optional. You need to register before you cross the threshold, not after.

- You’re considering changing business structure – Going from sole trader to limited company (or vice versa) has tax implications you shouldn’t navigate alone.

- You’ve hired your first employee – Congratulations! Now you’ve got PAYE, National Insurance, workplace pensions, and employment law to contend with.

- Your accounts are six months behind – If you’re “going to sort it eventually,” eventually needs to be now. The longer you wait, the worse it gets.

The Future of Small Business Accounting in the UK

Things are changing fast. AI is automating basic bookkeeping tasks. HMRC is getting better at spotting inconsistencies. Making Tax Digital is expanding its scope. Open Banking means your accountant can see your transactions in real-time.

What does this mean for you?

The administrative burden should decrease as automation handles routine tasks. But the need for strategic advice and human expertise? That’s increasing. Knowing which expenses to claim, how to structure your affairs tax-efficiently, and how to plan for growth – these require judgment, not just data entry.

The best small business accounting services in the UK are already adapting. They’re using technology to eliminate the boring stuff and focusing their human expertise on the parts that actually add value: strategy, planning, and proactive advice.

Making the Decision: Your Next Steps

If you’re still managing everything yourself and it’s working, brilliant. Keep doing what works. But if you’re spending Sunday evenings panicking about invoices, or if you’ve got a sinking feeling that your accounts aren’t quite right, it’s probably time.

Start by getting quotes from 2-3 firms. Have proper conversations – not just email exchanges. Ask them:

- What’s included in your packages, specifically?

- How do you communicate (email, phone, portal)?

- What software do you use and recommend?

- What happens if I miss a deadline or forget to send information?

- Can you provide references from similar businesses?

Pay attention to how they explain things. If they’re talking at you rather than with you, or if they can’t translate jargon into English, that’s a red flag.

Final Thoughts: It’s About More Than Just Numbers

The right small business accounting services shouldn’t feel like a grudge purchase. They should feel like having a business partner who handles the parts of your company you’d rather not think about.

You started your business to do something you’re good at – to solve problems, create products, provide services. You didn’t start it to become an expert in UK tax law or spend your evenings reconciling bank statements.

Proper accounting isn’t just about compliance (though that matters). It’s about freeing up your time and mental energy to actually grow your business. It’s about making better decisions because you understand your numbers. It’s about sleeping better because you know someone’s got your back when it comes to HMRC.

The cost? Far less than the mistakes you’ll make without help. The value? Potentially transformative.

So maybe it’s time to stop treating accounting as something you’ll “get round to eventually” and start treating it as the business advantage it actually is. Your future self will thank you. Your bank balance definitely will.

Frequently Asked Questions About Small Business Accounting Services

How much should I budget for small business accounting services?

Expect £600-£1,500 annually for sole traders with simple affairs, and £1,500-£4,000+ for limited companies with employees and VAT registration. Monthly bookkeeping adds £100-£300 depending on transaction volume. Remember that good accounting typically pays for itself through tax savings and avoided penalties.

Do I legally need an accountant for my small business?

No, there’s no legal requirement to hire an accountant in the UK. You can prepare and submit your own accounts and tax returns. However, limited companies must file proper accounts with Companies House, and getting these wrong can result in penalties. Most small business owners find professional help worth the cost.

What’s the difference between a bookkeeper and an accountant?

Bookkeepers handle day-to-day transaction recording, bank reconciliation, and basic financial records. Accountants typically handle tax returns, year-end accounts, strategic planning, and HMRC compliance. Many small business accounting services include both bookkeeping and accounting in their packages.

When should a sole trader consider becoming a limited company?

Generally, when your annual profit exceeds £40,000-£50,000, the tax savings from operating as a limited company can outweigh the increased accounting costs and compliance requirements. However, this depends on personal circumstances. An accountant can model both scenarios for your specific situation.

Can I claim accounting fees as a business expense?

Yes, accounting and bookkeeping fees are allowable business expenses and can be deducted from your profits before calculating tax. This includes fees for preparing accounts, filing tax returns, bookkeeping services, and professional consultations.

What happens if I miss a tax deadline?

HMRC charges automatic penalties for late submissions. For Self Assessment, the initial penalty is £100 if you’re one day late, increasing to £10 per day after three months. Late Corporation Tax returns also incur penalties starting at £100. Professional accounting services typically include deadline reminders to help prevent this.

Should I use accounting software even if I have an accountant?

Yes. Modern accountants work with cloud accounting software that both you and they can access. This means real-time collaboration, better record-keeping, and Making Tax Digital compliance. Most small business accounting services include software setup and training as part of their packages.

How do I know if my accountant is doing a good job?

Good accountants proactively communicate tax-saving opportunities, respond promptly to queries, file everything on time, and explain your accounts in plain English. If you only hear from them once a year at tax time, you’re getting the minimum service, not quality service.