Look, I’ll be honest with you. There’s something deeply unsettling about watching your bank balance grow whilst simultaneously having zero clue whether you’re making smart decisions or setting yourself up for a spectacular financial faceplant. It’s the modern paradox, isn’t it? We’ve got apps that track every latte, yet when it comes to the big stuff—pensions, property, inheritance tax—most of us are essentially wandering around blindfolded in Harrods, hoping we don’t accidentally buy a £10,000 handbag.

London makes this worse. Exponentially worse.

Because this isn’t just any city with normal financial concerns. This is a place where a studio flat costs more than a four-bedroom house in Yorkshire, where your salary sounds impressive until you realize it barely covers Zone 2 rent, and where the tax code seems specifically designed to confuse anyone who isn’t a chartered accountant with a PhD in Byzantine complexity.

Which brings me to financial advice in London—not the dodgy sort your mate’s cousin provides after three pints, but the actual, qualified, “I’ve seen this mess before and here’s how we fix it” kind. The sort that Ask Accountant delivers from their Merton office, where they’ve spent years untangling the financial spaghetti that London throws at people.

The £50,000 Question Nobody Asks (Until It’s Too Late)

Here’s what nobody tells you when you move to London or start earning proper money: the difference between adequate financial management and expert financial guidance can easily cost you the price of a decent car. Sometimes a house.

I spoke with someone last month—let’s call her Sarah because that’s not her actual name—who’d been doing her own tax returns for seven years. Thought she was being financially savvy. Turned out she’d been overpaying HMRC by roughly £4,000 annually because she didn’t understand capital allowances on her home office setup. That’s £28,000. Gone. Just… vanished into the Treasury’s coffers because she assumed “tax software” was the same as “tax expertise.”

It’s not.

Getting proper financial advice in London operates in a different league precisely because London’s financial landscape is genuinely bonkers. You’ve got:

- Property values that defy gravity and logic

- Business opportunities layered with regulatory tripwires

- Inheritance tax thresholds that haven’t kept pace with house prices (cheers for that)

- Multiple income streams from rental properties, freelance work, investments, side hustles

- Non-domicile considerations if you’re from overseas

- Stamp duty calculations that require a mathematics degree

Try handling that lot with a free app and a YouTube tutorial.

The Three Pillars That Actually Matter

Forget the fluffy motivational stuff about “securing your future” for a moment. Let’s talk about what practical financial advice in London actually does in real terms.

Security (Or: Not Losing What You’ve Built)

Protection first. Always.

Most people approach finances backwards. They think about growth—”How do I make more?”—before thinking about preservation—”How do I not lose what I already have?” This is like planning to run a marathon before learning to tie your shoelaces. Impressive ambition, terrible sequencing.

Proper financial advice in London starts with a brutally honest audit of your vulnerabilities. Where are you exposed? What happens if:

- Your tenant stops paying rent?

- HMRC decides to investigate your returns?

- Your business partner wants out?

- You suddenly inherit property and trigger a massive tax bill?

I’ve watched supposedly sophisticated businesspeople crumble when they received an unexpected inheritance tax demand. We’re talking bright, capable individuals who simply didn’t know that inheriting their parents’ now-£1.5 million London home would land them with a bill they couldn’t possibly pay without selling the house itself.

Inheritance tax planning isn’t just for the wealthy. In London, it’s for anyone whose parents had the wisdom (or luck) to buy property before 1995. Services like those offered by Ask Accountant—covering everything from inheritance tax strategies to comprehensive business advice—exist precisely because London’s property inflation has turned ordinary families into accidental millionaires with extraordinary tax liabilities.

| Financial Risk | Why It Matters in London | Typical Cost of Ignoring It |

| Inadequate tax planning | Complex income sources, property transactions, business structures | £3,000-£15,000 annually in overpayment or penalties |

| Inheritance tax exposure | Property values far exceed IHT threshold (£325k) | 40% of estate value above threshold |

| Missing CIS refunds | Construction industry workers often overpay through deductions | £2,000-£8,000 in unclaimed refunds |

| Poor business structure | Sole trader vs. limited company decision affects tax burden significantly | £5,000-£20,000+ annually depending on income |

| Non-compliance with auto-enrolment | Legal requirement for businesses with employees | Fines starting at £400, escalating to £10,000+ |

Strategy (Or: Playing Chess Whilst Everyone Else Plays Checkers)

This is where good financial advice in London separates itself from mere bookkeeping.

Anyone can tell you what happened last quarter. A decent accountant can file your returns accurately. But a proper financial adviser? They’re three moves ahead, asking questions like:

“You’re planning to buy that second property? Brilliant. Have you considered whether purchasing through a limited company would save you £40,000 over five years compared to personal ownership? Also, what’s your exit strategy if Labour implements their threatened property tax reforms?”

See the difference?

Strategic advice means understanding the entire chessboard—tax implications, business growth planning, investment opportunities, regulatory changes that aren’t even law yet but probably will be soon. It’s having someone who reads budget announcements the way football fans read transfer news, immediately calculating what it means for your specific situation.

Take CIS claims and refunds as an example (relevant if you’re anywhere near the construction industry). Most contractors know they can claim back overpaid tax. Far fewer understand the strategic timing of those claims, how to structure their business to minimize deductions in the first place, or which expenses can be offset against CIS deductions. That nuanced understanding? That’s the difference between getting a nice refund and optimising your entire financial structure.

Success (Or: Actually Growing The Damn Thing)

Right, security’s sorted, strategy’s in place. Now what?

Now you actually build something.

This is where business advisory and proactive tax advisory solutions stop being boring accountancy jargon and start being the rocket fuel for whatever you’re building. Because here’s the thing about London: the opportunities are genuinely massive. The competition is equally massive. And the margin for error is approximately zero.

Your business can’t grow if you’re:

- Drowning in bookkeeping you don’t understand

- Terrified of expanding because you don’t know the tax implications

- Making decisions based on outdated financial information

- Spending three days a month wrestling with spreadsheets instead of, you know, actually running your business

Small business accounting services in London aren’t just about keeping HMRC happy (though that’s obviously crucial). They’re about freeing you to do what you’re actually good at whilst someone else handles the financial architecture.

I’m thinking of a client—okay, I’m thinking of about fifteen clients—who transformed their businesses not by working harder or finding some magic marketing trick, but simply by getting their numbers properly organised. Suddenly they could see which services were actually profitable (not always the obvious ones), which clients were costing them money, where to invest, and where to cut back.

That’s not mystical financial wizardry. That’s just having accurate, timely, interpreted financial information. But in London’s fast-moving market, it’s the difference between thriving and merely surviving.

The London Premium: Is It Worth It?

Here’s a question I get asked constantly: “Why do I need London-specific financial advice in London? Surely tax law is the same everywhere?”

Technically correct. Practically not viable.

Yes, tax law is uniform across the UK. But the way that law applies in London versus, say, Lincolnshire is wildly different because the financial situations are completely different.

Consider:

- Property values: The average London house price is roughly £535,000. The IHT threshold is £325,000 (or £500,000 with the residence nil-rate band). In most of the UK, inheritance tax is a problem for the wealthy. In London, it’s a problem for anyone whose parents bought a house.

- Business costs: Your office rent in Central London might be £50,000 annually. That’s a significant capital allowance claim, affects your profit margins differently, and changes the entire calculation of whether you should even have a physical office versus going fully remote.

- Income levels: London salaries typically run 20-30% higher than regional equivalents, which sounds great until you realize you’re being pushed into higher tax brackets whilst your actual standard of living might be lower because everything costs more.

- Complexity: Multiple income streams are normal here. Rental income, freelance work, limited company dividends, investment income—managing these requires sophisticated understanding of how they interact tax-wise.

Financial advice in London isn’t more expensive because advisers are greedy (though Merton High Street rents probably don’t help). It’s more expensive because the problems are genuinely more complex.

What Decent Financial Advice Actually Looks Like

Let me paint you a picture of terrible financial advice in London first, because we’ve all encountered it.

Terrible advice is generic. It’s the financial equivalent of “have you tried turning it off and on again?”—technically sensible, completely unhelpful. It comes in templated emails, involves lots of impressive-sounding terminology that means nothing specific, and never actually answers your question.

Terrible advice is reactive. Something goes wrong, you panic, you call them, they put out the fire (maybe), then disappear until the next crisis.

Terrible advice treats you like an idiot or, worse, like a revenue stream.

Now, proper advice?

Proper financial advice in London is conversational. Someone picks up the phone when you call (revolutionary, I know). They explain things in English, not accounting jargon. When you ask “Should I register for VAT?” they don’t just say “Yes” or “No”—they walk through the implications for your specific situation, possibly drawing diagrams if you’re lucky.

Proper advice is proactive. You’re not calling them; they’re calling you. “Hey, I saw the autumn budget announcement about capital gains tax. Given your property portfolio, we should talk about restructuring before April. Got twenty minutes this week?”

Proper advice is integrated. They understand your business advisory needs connect to your tax advisory solutions, which connect to your bookkeeping, which connects to your business growth planning. It’s not siloed services; it’s a comprehensive understanding of your financial life.

This is what places like Ask Accountant aim for—that holistic approach where accounting and bookkeeping aren’t separate from strategic planning, where business accounting services flow naturally into business growth advice, where they’re tracking regulatory changes and thinking about how those changes affect your specific circumstances.

The Questions Nobody Asks (But Absolutely Should)

When you’re evaluating financial advice in London—whether you’re talking to Ask Accountant at their Merton office or anyone else—here are the questions that actually matter:

“What happens if I don’t hear from you for six months?”

If the answer is “Well, you can always call us,” run away. Good financial advisers don’t wait for you to realize you have a problem. They’re monitoring your situation, tracking regulatory changes, reaching out proactively.

“How do you handle disagreements with HMRC?”

Because at some point, you probably will get that dreaded brown envelope. You want someone who’s fought these battles before, knows the rules better than the tax inspector, and won’t crumble when challenged.

“Can you explain inheritance tax to me like I’m a reasonably intelligent adult who simply doesn’t work in finance?”

Their ability to translate complexity into clarity tells you everything about whether they’re actually competent or just hiding behind jargon.

“What’s your typical response time?”

Because “we aim to respond within 48 hours” is very different from “I’ll text you back within two hours if it’s urgent.”

“Do you handle [specific weird situation relevant to your life]?”

Maybe you’re a non-dom. Maybe you’ve got cryptocurrency holdings. Also, maybe you’re in construction and need CIS expertise. Maybe you run a business with complex supply chains. Whatever your particular flavour of financial complexity, they should either have direct experience or be honest about their limitations.

The Construction Industry Side Quest

Quick tangent (because this affects more Londoners than you’d think): if you’re in construction, understanding CIS claims and refunds is genuinely crucial.

The Construction Industry Scheme is HMRC’s way of ensuring tax compliance in an industry notorious for cash-in-hand work. Basically, contractors deduct money from your payments and send it directly to HMRC. Sometimes they deduct too much. Sometimes they deduct way too much.

| Your Status | Standard CIS Deduction | What This Means |

| Registered (Gross Payment) | 0% | You receive full payment, handle your own tax |

| Registered (Net Payment) | 20% | Contractor deducts 20% from your labour payment |

| Not registered with HMRC | 30% | Ouch. Contractor deducts 30% from labour payment |

The problem? Many construction workers don’t realize they can claim substantial refunds if those deductions exceed their actual tax liability. Or they don’t understand that materials, travel, and equipment expenses can offset their tax bill. Or they’re operating as sole traders when a limited company structure would be far more tax-efficient.

This is exactly the kind of specialised knowledge where London-based expertise matters. An accountant in rural Somerset might handle one or two CIS cases annually. An accountant in London—especially in areas like Merton with significant construction activity—might handle hundreds. That volume breeds expertise you can’t fake.

Small Business, Big Headaches

The romance of entrepreneurship: waking up without an alarm, being your own boss, building something meaningful.

The reality of entrepreneurship: discovering that auto-enrolment pension schemes for your three employees require about forty-seven different forms, none of which make any sense.

Small business accounting services in London exist primarily to prevent capable business owners from having nervous breakdowns over administrative requirements that have nothing to do with their actual business.

You started a design agency because you’re brilliant at design. Not because you wanted to spend every January in a cold sweat trying to remember which receipts are legitimate business expenses and which ones are technically personal even though you used that coffee shop as your office for three months.

Someone recently told me they spent fourteen hours preparing their VAT return. Fourteen hours! That’s nearly two full workdays not serving clients, not developing new business, not doing literally anything productive. Just wrestling with paperwork that a competent bookkeeper could handle in roughly ninety minutes.

The maths is very simple: if your time is worth £50/hour to your business (and it probably should be worth more), those fourteen hours cost you £700 in opportunity cost. Meanwhile, professional bookkeeping might cost £150-300. You do the maths.

But it’s not even just the time—though that alone justifies it. It’s the certainty. Knowing your books are correct, your returns are filed properly, your business structure is optimised for your specific situation. That mental freedom is priceless.

When DIY Finance Becomes Expensive

Look, I respect people who want to learn this stuff themselves. I genuinely do. Financial literacy is important. Understanding the basics of taxation, business structure, investment principles—all good things.

But there’s a difference between financial literacy and financial expertise. And mistaking the former for the latter can get expensive fast.

Common DIY disasters I’ve seen:

- The “I’ll Just Register As A Limited Company” Mistake: Because someone told them limited companies are more tax-efficient. Which they can be. But not always. And definitely not if you don’t actually understand dividend tax rules, corporation tax returns, Capital Gains Tax implications when you eventually sell the company, or the administrative burden you’ve just signed up for.

- The “I Don’t Earn Enough To Worry About Tax Planning” Mistake: Usually uttered by someone earning £60,000+ who could be saving thousands through pension contributions, capital allowances, business expense optimisation, or income splitting with a spouse. But they’re not, because they think tax planning is for rich people.

- The “I’ll Deal With Inheritance Tax When The Time Comes” Mistake: Spoiler alert—when the time comes, it’s too late. Inheritance tax planning needs to happen years in advance. That expensive London property your parents own? Start the conversation now, not when you’re grief-stricken and facing a six-figure tax bill you can’t pay without selling the family home.

- The “Accountants Are All The Same” Mistake: They’re really not. Some specialise in large corporations. Some focus on individuals. Some understand specific industries inside-out (like construction and CIS). Some offer comprehensive business advisory; others just file your annual return and disappear. Choosing the wrong specialist is like hiring a divorce lawyer to handle your commercial property transaction—they’re qualified, they’re just qualified for the wrong thing.

Growth Without Chaos

Here’s what sophisticated business growth planning actually involves (hint: it’s not “try to get more clients”):

- Understanding your numbers well enough to identify profitable vs. unprofitable activities

- Structuring your business to support scaling without proportionally scaling your headaches

- Creating financial systems that provide you with real time cashflow.

- Making big decisions with the thought of tax implications (hiring, expanding, acquiring assets, taking on investment).

- Developing backup strategies in the unavoidable turbulent times.

That last one’s crucial. No business is free of bad times. It isn’t so much the magnitude of the issue that can be the difference between a thriving business and a failed business, but rather whether this business had financial buffers, could see their true financial status, and had advisors who were helpful in the period of turbulence and not falling and panicking alongside them.

The proactive tax advisory solution implies that your advisor is not responding to what has already occurred but would be assisting you to organize your choices in the most favorable way. You consider to hire your first employee? Your good adviser is already clarifying the issues of auto-enrolment, PAYE administration, National Insurance contributions, and whether or not there can be superior solutions (contractors, agencies, automation) in your particular case.

You’re considering a significant equipment purchase? They’re walking through capital allowances, annual investment allowances, whether leasing might make more financial sense than buying, and how the timing affects your tax position.

This is the stuff that sounds boring until suddenly it’s costing you thousands because you didn’t know it existed.

The Merton Advantage (Or: Why Location Still Matters In A Digital World)

Quick word about geography, since we’re talking about London-specific advice.

Yes, you can Zoom with an accountant based anywhere. I’m not disputing that video calls work. But there’s something genuinely valuable about having financial advisers who understand your specific corner of London.

Ask Accountant operates from 178 Merton High St, London SW19 1AY (phone: +44(0)20 8543 1991). That’s not accidental positioning. Merton’s an interesting area financially—you’ve got established homeowners sitting on enormous property wealth, you’ve got growing businesses, you’ve got the construction industry very active, you’ve got people navigating the exact inheritance tax minefield I mentioned earlier.

An accountant based there understands Merton property values, local business landscape, common financial situations their neighbours face. They’re not learning your context from scratch; they live in it.

Does this matter? Sometimes yes, sometimes no. But when you’re discussing whether your property value puts you in inheritance tax territory, having someone who instinctively understands South West London property markets helps. In trying to compute the business rates it helps to have someone who understands the peculiarities of a certain borough.

It’s not make-or-break. But it’s something.

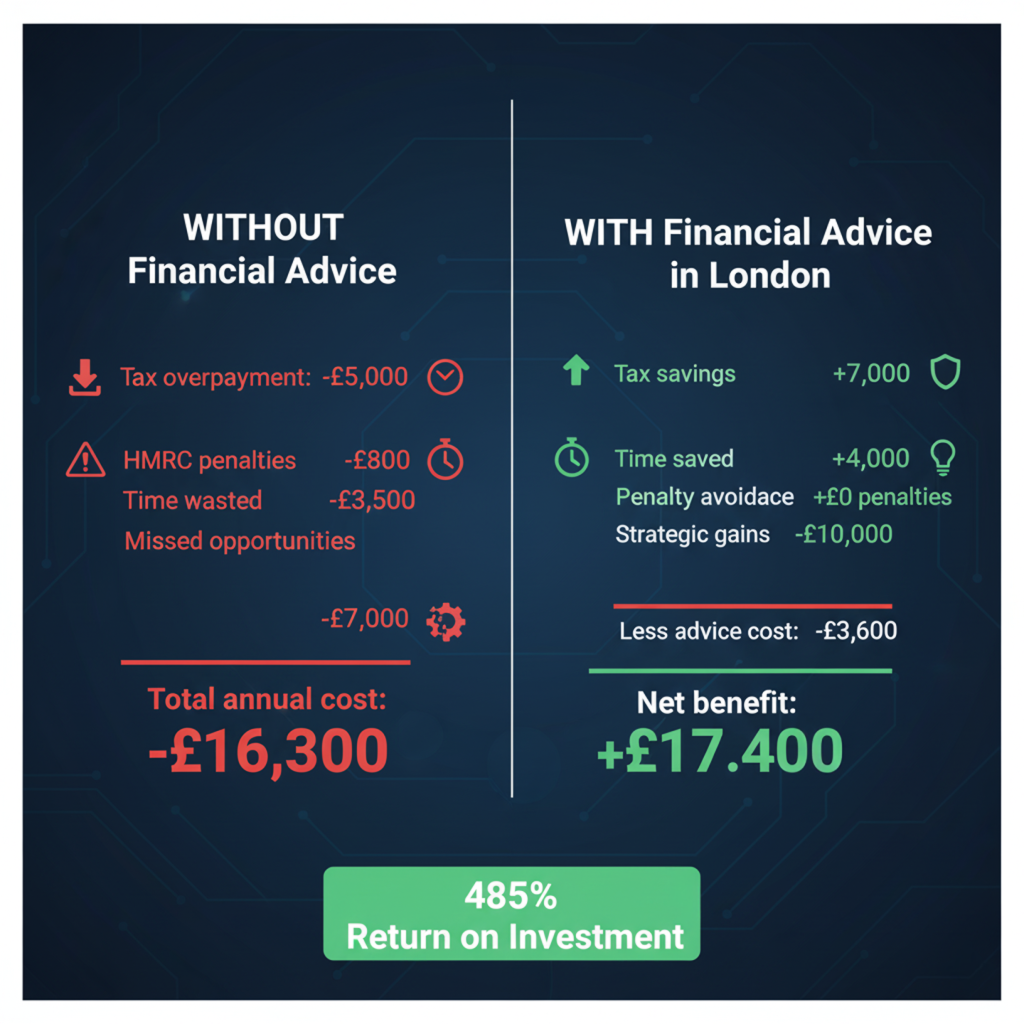

The Actual ROI of Good Advice

Mercenary let us be awhile.

Suppose you take reasonable financial recommendations in London (not the most expensive, not the cheapest, simply good professionals who understand what they are about), what is the payoff?

- Tax savings: most small businesses and higher earning people will save between 3000 and 10000 in taxes each year through better expense claims, allowances, optimal timing and structure and taxation.

- Time saved: 50-100 hours/year which you are not using on bookkeeping, tax returns, financial administration. At the value of time (business) of £50/hour, you have saved an opportunity cost of 2,500-5000.

- Penalty avoidance: The HMRC fines for late returns, misleading information or non-compliance may be fined between 100 and thousands of pounds. Professional treatment usually implies zero punishment.

- Strategic value: You cannot quantify it, but making the appropriate business structure, making the right decisions at the right time, and knowing how much you are actually making, making such decisions add up over the years. Conservative estimate: better decision-making, between 5000-15000 yearly.

Total it and good financial advice can be able to pay back many times over. If it’s not, you’ve either chosen the wrong adviser or your financial situation is genuinely simple enough that you don’t need ongoing support (rare in London, but possible).

Red Flags To Watch For

Not all financial advice in London is created equal. Here’s what should trigger alarm bells:

- They promise certain results: There is no reputable financial consultant who will promise you that you will pay X in taxes or save Y. They are capable of estimating, they are capable of optimising, but the tax law is complicated and the case is different in individual situations. Guarantees imply either inability or fraud.

- They’re weirdly cheap: Proper accounting services have real costs—professional insurance, software, qualified staff, ongoing training. If someone’s doing proper bookkeeping and tax advisory for £50/month, they’re either losing money (unsustainable) or cutting corners (dangerous).

- They never ask questions: Good advisers want to understand your specific situation in detail. When a person advice you without inquiring about your objectives, conditions, risk-taking, and strategies, they are guessing.

- You can never get to them: Financial things do not respectfully wait till times are good. The problem with always missing your adviser is that one day you will be in an emergency that they will not be able to assist due to time constraints.

- It’s all an upsell: Yes, full-fledged services are more expensive than simple bookkeeping. However, when all communications have become sales pitches to get more services which you do not need, something goes wrong.

FAQ: The Questions That All People Secretly Wish to Know.

Q: When is it really time to hire someone to professionally do my financial advice and not just use accounting software?

A: The tipping point can be considered as a period when your monetary condition includes several moving elements. Simple expenses, no business, no property, one source of income? Software probably works. However, increase rental income, or begin a business, or inherit property, or anything more complex than simple employment, and the professional advice soon recovers itself in error prevented and decisions made optimally.

Q: What is the difference between the accountant, financial advisor and the tax specialist?

A: There is overlapping, however: accountants deal with bookkeeping, tax returns, business accounts and compliance in general. The financial advisers are concerned with investment strategy, wealth management and retirement planning (and fall under the FCA). Tax professionals go into nitty-gritty of tax optimisation, planning and HMRC. Many practices like Ask Accountant offer multiple services under one roof—business accounting services, tax advisory solutions, business advisory—which is convenient for integrated planning.

A: How likely would I be to pay a good amount of money to get financial advice in London?

A: highly that is fluctuated by the complexity. Simple accounting of a small business: £100-300 per month. Full accounting and advisory services to a developing business: 300 -1000+ a month. One off tax planning or advice: 500-2000+. Hourly rates range between £100- 300 based on seniority and specialisation. London is about 2030 percent more expensive than the regional rates, but it is worth it.

Q: Can I handle inheritance tax planning myself?

A: Technically yes, practically risky. IHT rules are complex, timing matters enormously (many strategies require seven years to become effective), and mistakes can cost your beneficiaries hundreds of thousands. At minimum, get professional inheritance tax advice once to understand your exposure and options, then decide if you want ongoing support.

Q: What should I bring to my first meeting with a financial adviser?

A: Recent tax returns (last 2-3 years), business accounts if applicable, details of income sources, property information, investment statements, pension information, and a clear idea of what you’re trying to achieve or solve. There is no need to have everything in order, good advisers can operate on disorderly information, only that they require the pieces.

Q: What would I do to know whether my current accountant is good or not?

A: Inquire: Do they make the proactive phone call to you regarding tax-saving opportunities? Are they fast in responding to questions? Are they clear in their elucidations? Is it their work that makes you understand your financial position better? Have you received any fines or disciplinary problems? Do they appear to know your industry and the challenges that are involved? If you’re answering “no” to most of these, shop around.

Q: Is it worth paying more for specialised knowledge (like CIS claims or business advisory)?

A: Absolutely, if that specialisation is relevant to you. Generic accounting might miss opportunities or requirements specific to your situation. Construction workers benefit enormously from accountants who do dozens of CIS claims annually. Growing businesses benefit from advisers who understand business growth planning and scaling challenges. The specialised knowledge typically pays for itself through avoided mistakes and captured opportunities.

The Uncomfortable Truth About Money Management

Nobody actually wants to think about this stuff.

We’d all prefer to focus on earning money, spending money, enjoying money. The administrative machinery of managing money properly? That’s about as appealing as organising your sock drawer whilst someone reads building regulations aloud.

But here’s the thing: that administrative machinery determines whether you keep your money, whether it grows, whether you avoid nasty surprises, and whether you build something sustainable rather than something that collapses the moment you hit a rough patch.

Good financial advice in London isn’t about making finance fun (it’s not going to be fun). It’s about making it manageable, understandable, and importantly—making it someone else’s problem. Someone qualified whose job is to stay current on tax law changes, compliance requirements, optimisation strategies, and all the desperately boring but genuinely important stuff that protects and grows your wealth.

You focus on what you’re good at. Let competent professionals handle the financial architecture. That’s not admitting defeat; that’s smart division of labour.

Final Thoughts (Or: Just Call Someone, Seriously)

If you’ve read this far, you probably fall into one of three categories:

- You’re already convinced you need professional financial help and you’re procrastinating actually getting it

- You’re still on the fence and hoping this article will make the decision for you

- You’re an accountant checking out the competition (hello colleague)

For category one: Stop procrastinating. Pick up the phone. Whether you call Ask Accountant at +44(0)20 8543 1991 or someone else entirely, just make the call. Every month you delay is probably costing you money.

For category two: Here’s your sign. If you have any financial complexity—business income, rental income, significant assets, inheritance considerations, growing earnings, confusion about your tax position—you need help. The fence-sitting phase is over.

For category three: I’ve hope this article gave you some ideas about communicating value without resorting to corporate nonsense.

Financial advice in London isn’t a luxury purchase. It’s infrastructure. It is the basis on which all others can function well. Get going with the foundation and you can construct whatever you desire on the foundation. Misjudge it and you are going to waste years of your life fixing cracks as the money is draining through your fingers to pay unnecessary taxes and penalties, lost opportunities, and other entirely preventable issues.

Get your place, make your plan, attain your victory. Or at least quit spending blood by means of holes in your financial structure that can easily be sealed.

The decision, according to them, lies with you. However, the more time you delay the more costly that option will be.