Here’s something nobody tells you at dinner parties: inheritance tax isn’t just for the wealthy anymore. I’ve watched too many families discover this the hard way—right when they’re grieving, already overwhelmed, and suddenly facing a tax bill that could’ve been avoided (or at least reduced) with a bit of planning.

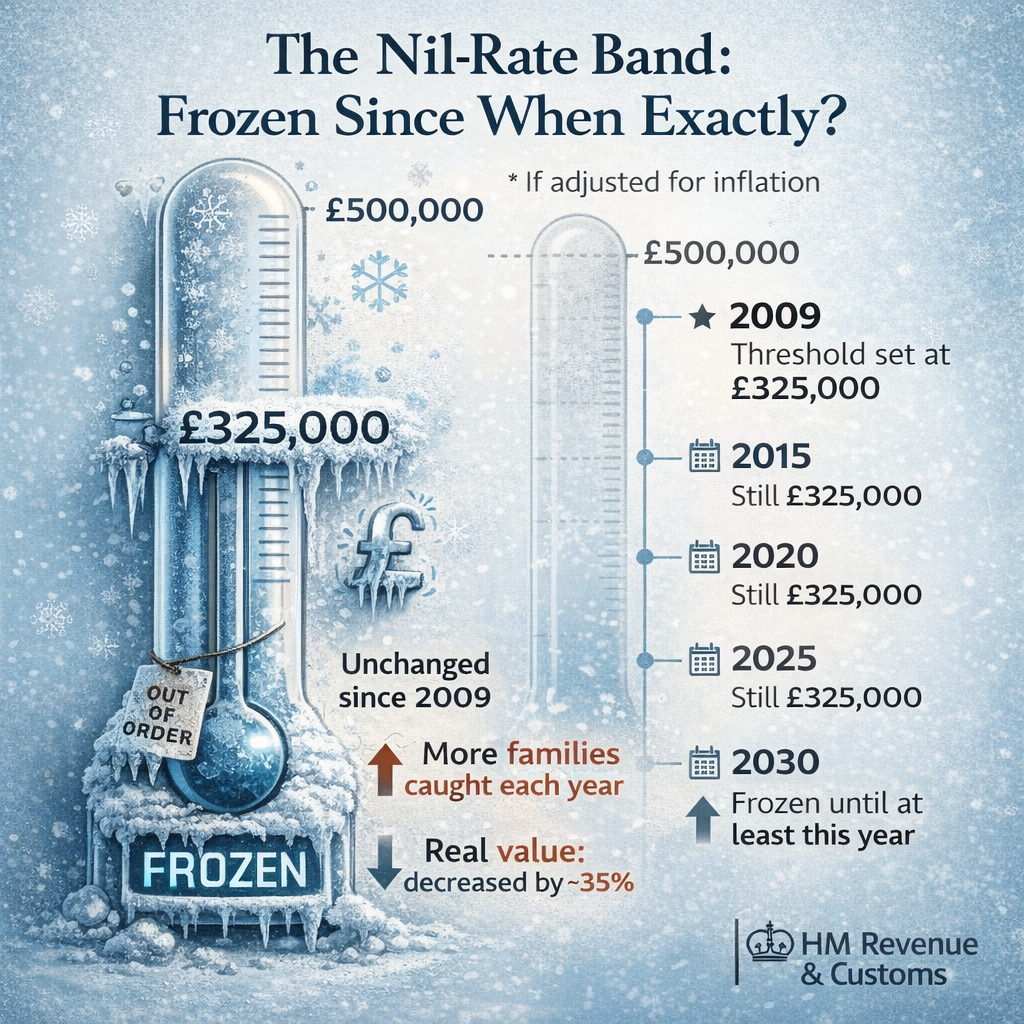

The problem? Most people think inheritance tax only affects estates worth millions. Wrong. With house prices doing what they’ve done over the past decade and thresholds frozen since 2009, more ordinary families are getting caught in HMRC’s net than ever before. In fact, inheritance tax receipts hit £7.6 billion in the 2024/25 tax year—and that number’s climbing.

Look, I get it. Tax planning sounds about as exciting as watching paint dry. But when we’re talking about potentially losing 40% of everything you’ve worked for? That’s worth twenty minutes of your time. And if you’ve landed on this page, you’re already asking the right questions. So let’s talk about what you’ll actually pay, not what some government leaflet says you might.

What Actually Counts as Your Estate (and Why It Matters)

Before we dive into numbers, let’s get something straight—your estate isn’t just your bank account. It’s everything. Your home, obviously. But also your car, that collection of vintage watches gathering dust, your ISAs, premium bonds, life insurance payouts (if they’re not in trust), and yes, even Grandad’s antique desk you’ve been meaning to sell.

The taxman doesn’t miss much. They’ll tot up the lot and if it exceeds certain thresholds, inheritance tax kicks in at a frankly eye-watering 40%.

Now here’s where it gets interesting (and by interesting, I mean potentially expensive): HMRC doesn’t just look at what you own when you die. They also look back seven years at any substantial gifts you made. Given someone a chunk of cash to help with a house deposit? Transferred property to your kids? These could still be counted if you don’t survive seven years—more on that minefield later.

The Magic Numbers You Need to Know

Right, let’s talk thresholds because this is where most confusion happens.

The basic allowance—called the nil-rate band—is £325,000 per person. Has been since 2009. If Gordon Brown was still Prime Minister when this threshold was set, you know it’s been a while. Had it risen with inflation, we’d be looking at around £500,000 today. But no. The government’s frozen it until at least 2030, which means more estates creep over the line each year.

Then there’s the residence nil-rate band, which is an additional £175,000—but only if you’re leaving your main home to direct descendants (children, grandchildren, even stepchildren count). That gives you a potential total allowance of £500,000 per person, or £1 million for married couples.

Sounds generous? Here’s the catch: if your estate’s worth more than £2 million, they start taking away that residence band. £1 for every £2 over the limit. So if you’ve got a £2.5 million estate, you’ve already lost half of it. The whole thing vanishes at £2.35 million for a single person.

| Allowance Type | Amount (Single Person) | Amount (Married Couples) | Key Conditions |

|---|---|---|---|

| Nil-Rate Band | £325,000 | £650,000 | Available to everyone; transferable between spouses |

| Residence Nil-Rate Band | £175,000 | £350,000 | Only when main home passes to direct descendants |

| Total Potential Allowance | £500,000 | £1,000,000 | Subject to estate value and beneficiary conditions |

| Taper Threshold | £2 million | £2 million | Residence band reduces by £1 for every £2 over threshold |

The Real Cost: Let Me Show You the Maths

Theory’s all well and good, but let’s look at actual scenarios.

Example 1: Sarah’s straightforward situation

Sarah’s single. She’s got £450,000 in savings and investments but doesn’t own property. Her inheritance tax calculation is brutally simple:

- Estate value: £450,000

- Minus nil-rate band: £325,000

- Taxable amount: £125,000

- Tax at 40%: £50,000

Her beneficiaries receive £400,000. HMRC gets £50,000. No residence band applies because there’s no property passing to children.

Example 2: David’s more complex picture

David owns a house worth £400,000 and has £250,000 in other assets (total: £650,000). He’s leaving everything to his two children. Now we can use both allowances:

- Nil-rate band: £325,000

- Residence nil-rate band: £175,000

- Total allowances: £500,000

- Taxable amount: £150,000

- Tax at 40%: £60,000

Without that residence band, his kids would’ve paid £130,000 instead of £60,000. That’s why it pays to understand these rules.

Example 3: The married couple advantage

Robert and Linda are married. Their combined estate is worth £1.2 million, including a £600,000 family home. When Robert dies first, he leaves everything to Linda—zero tax, because spouse exemptions are unlimited. When Linda dies, their children inherit. Here’s what happens:

- Combined nil-rate bands: £650,000

- Combined residence nil-rate bands: £350,000

- Total allowances: £1,000,000

- Taxable amount: £200,000

- Tax at 40%: £80,000

Had they not been married or civil partners, the bill would’ve been substantially higher across both deaths.

That Seven-Year Rule Everyone Misunderstands

People love to talk about the seven-year rule like it’s some sort of magic wand. “Just give your money away and wait seven years!” they say at barbecues. And yes, there’s truth to it—but also plenty of ways it can go wrong.

The basic principle: if you make a gift and survive seven years, it’s usually outside your estate for inheritance tax purposes. These are called Potentially Exempt Transfers (PETs). The “potentially” is doing a lot of heavy lifting there.

Die within three years? The gift gets added back to your estate and taxed at the full 40%. Die between three and seven years? Welcome to taper relief, which sounds complicated but actually isn’t:

| Years Between Gift and Death | Tax Rate Reduction | Effective IHT Rate |

|---|---|---|

| 0-3 years | 0% | 40% (full rate) |

| 3-4 years | 20% | 32% |

| 4-5 years | 40% | 24% |

| 5-6 years | 60% | 16% |

| 6-7 years | 80% | 8% |

| 7+ years | 100% | 0% (no tax) |

Critical point that trips people up: Taper relief only applies to gifts over the nil-rate band. If you give away £200,000 and die five years later, assuming you haven’t used your nil-rate band elsewhere, there’s no tax anyway. The relief only matters when your total gifts exceed £325,000.

The “Gift with Reservation” Trap

Here’s where people get creative—and where HMRC says “nice try.” You can’t give your house to your children and then continue living in it rent-free. Well, you can, but for inheritance tax purposes, it’s as if you never made the gift.

This is called a “gift with reservation of benefit.” If you continue benefiting from something you’ve supposedly given away, HMRC treats it as still part of your estate. Want to gift the house and stay living there? You’ll need to pay market rent. Properly. With a tenancy agreement and everything.

The same principle applies if you gift money to your children to buy a holiday home—and then use it for free whenever you fancy.

Exemptions and Allowances Most People Forget

Not everything triggers the seven-year clock. Some gifts are immediately exempt, which is where smart planning comes in.

The £3,000 annual exemption lets you give away that amount each tax year without it counting toward your estate. Didn’t use it last year? You can carry forward one year’s unused allowance (but only one year). So theoretically, you could give £6,000 this year if you gave nothing last year.

Small gifts of £250 per person are also exempt—you can give these to as many people as you want, but you can’t combine this with the annual exemption for the same person. No giving someone £3,250 and claiming both allowances.

Wedding gifts have their own scale:

- £5,000 to a child

- £2,500 to a grandchild or great-grandchild

- £1,000 to anyone else

These are on top of other exemptions, so you could give your child £3,000 (annual exemption) plus £5,000 (wedding gift) in the same year—£8,000 total, all immediately exempt.

Regular gifts from income are perhaps the most underused exemption. If you can demonstrate that you’re making regular gifts from surplus income (not capital), and you can still maintain your normal standard of living, there’s no limit on how much you can give away.

The catch? You need to keep meticulous records. HMRC won’t just take your word for it. Document each payment, show your income sources, prove it’s regular and habitual. Many people use this to pay grandchildren’s school fees or make monthly contributions to family members. Done correctly, it’s powerful—but you’ve got to do the paperwork.

There’s more detail on gift rules here if you want to explore this further, but the key takeaway is that with proper planning, you can move significant wealth outside your estate without triggering any clocks or waiting periods.

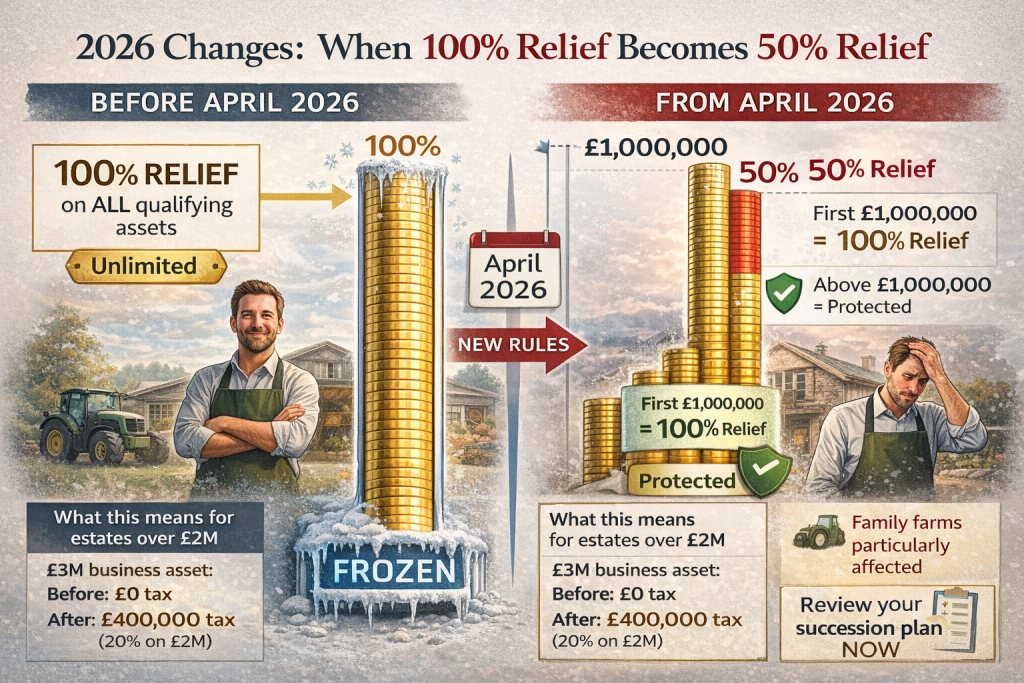

Business and Agricultural Relief: The Big Tax Breaks (Changing in 2026)

If you own a business or farm, inheritance tax rules have historically been remarkably generous. Business Property Relief (BPR) and Agricultural Property Relief (APR) could give you up to 100% relief—meaning qualifying assets passed on completely tax-free.

But—and this is a significant but—things are changing from April 2026.

Under the new rules, full relief will only apply to the first £1 million of combined agricultural and business property. Anything above that gets 50% relief, which effectively means a 20% inheritance tax rate instead of 40%. Still better than nothing, but a dramatic shift for larger estates.

This particularly affects family farms and trading businesses. If you’ve been relying on these reliefs for succession planning, you’ve got until April 2026 to review your strategy. After that, estates that previously paid nothing could face substantial tax bills.

For business relief to apply, you generally need to have owned the business for two years and it must be a genuine trading business—property investment doesn’t count. The business must be actively trading, not just holding investments or generating passive income.

Agricultural relief works similarly. The farm property must have been occupied for agricultural purposes, and ownership requirements are two years if you farm it yourself, seven years if it’s let to someone else.

If this affects you, professional business advice isn’t optional anymore—it’s essential. These changes represent some of the most significant reforms to inheritance tax in decades, and getting it wrong could cost your family hundreds of thousands of pounds.

Pensions: The Last Tax-Free Haven (For Now)

Here’s something many people don’t realise: defined contribution pensions usually sit outside your estate for inheritance tax purposes. That makes them one of the most tax-efficient ways to pass on wealth.

If you die before age 75, your pension can pass to beneficiaries completely tax-free—no income tax, no inheritance tax. Die after 75, and beneficiaries pay income tax on withdrawals at their marginal rate, but still no inheritance tax.

This creates an interesting planning opportunity. If you have other assets you could live on, leaving your pension untouched can be incredibly tax-efficient for the next generation. Many people do the opposite—they raid their pension and leave property, which then gets walloped with 40% inheritance tax.

But (because there’s always a but): from April 2027, inherited pensions will be liable for inheritance tax. Combined with income tax for those dying after 75, we could be looking at effective rates of up to 67%.

So if you’re currently in the sweet spot—pension funds that could pass tax-free—the next couple of years are crucial for planning. After 2027, the landscape looks very different.

Domicile Changes: What Non-Doms Need to Know

This is technical, and frankly, it won’t apply to most people reading this. But if you’re a long-term UK resident who previously claimed non-domiciled status, pay attention.

From April 2025, the UK moved from a domicile-based system to a residence-based one for inheritance tax. If you’ve been UK resident for 10 out of the previous 20 tax years, you’re now considered a “long-term resident” and your worldwide assets fall within the UK inheritance tax net.

Leave the UK? You’ll remain within the inheritance tax system for a period ranging from three to 10 years, depending on how long you were resident. The minimum tail is three years (for those resident 10-13 years), rising to a maximum of 10 years for longer-term residents.

For internationally mobile families, this is a complete paradigm shift. Offshore structures that previously sheltered assets may no longer work. Trust arrangements need reviewing. Many people who thought they’d planned effectively are discovering their strategies no longer hold up under the new rules.

If this sounds like your situation, you need specialist tax planning advice. This isn’t something you can DIY with Google.

What About Trusts? (Spoiler: They’re Complicated)

Trusts used to be the go-to solution for inheritance tax planning. These days? They’re still useful, but they come with their own tax charges that make them less attractive than they once were.

Put assets into most trusts and you’ll face:

- An immediate charge of 20% on anything over £325,000 (for lifetime transfers to trusts)

- A 10-yearly charge of up to 6% on the value of trust assets

- Exit charges when assets are distributed

That said, trusts can still make sense for certain situations—protecting vulnerable beneficiaries, managing complex family structures, or controlling how and when assets are distributed. But they’re no longer the tax-saving magic bullet they were twenty years ago.

The rules for trusts are Byzantine, and getting them wrong can be expensive. If you’re considering this route, you need professional advice. Not optional. The days of setting up a trust with a DIY kit from the internet are long gone—if they ever existed in the first place.

Practical Steps You Can Take Now

Right, enough doom and gloom about tax bills. What can you actually do about all this?

1. Get your estate valued properly

You can’t plan if you don’t know where you stand. List everything—property, savings, investments, life insurance, business interests, even valuable possessions. Don’t guess. Get professional valuations for property and significant assets. Many people drastically underestimate what they own.

2. Make a will (a proper one)

Shockingly, around 60% of UK adults don’t have a will. If you die without one, intestacy rules decide who gets what—and they’re not designed for tax efficiency. A properly drafted will can save your beneficiaries thousands, if not hundreds of thousands.

3. Use your exemptions

That £3,000 annual exemption? Use it. Every year. Even if you’re healthy and planning to live to 100, that’s £3,000 you’ve moved out of your estate immediately, no seven-year wait required. Compound this over a couple, and you’re moving £6,000 a year completely tax-free.

4. Consider gifts now rather than later

If you can afford to give money or assets to your children or grandchildren now, why wait? The seven-year clock starts ticking from the date of the gift. Every year you delay is another year they have to wait for those assets to fall outside your estate.

5. Review life insurance arrangements

Life insurance payouts usually count toward your estate unless the policy is written in trust. Many people have substantial life cover they’ve forgotten about, which could push their estate over the inheritance tax threshold. Check your policies. If they’re not in trust, they probably should be.

6. Keep records of everything

When someone dies, executors need to compile a complete picture of gifts made in the previous seven years. If there aren’t proper records, it’s a nightmare. Document every significant gift—date, amount, recipient. Future you (or more accurately, your executors) will be grateful.

7. Review regularly

Estate planning isn’t a “set and forget” exercise. Asset values change. Tax rules change. Family circumstances change. Review your arrangements every few years, or whenever something significant happens—marriage, divorce, children, house purchase, business sale.

For comprehensive inheritance tax planning, it genuinely helps to have someone in your corner who stays on top of the constant rule changes and knows how to structure things efficiently.

When “Free” Advice Costs You More

Look, I know getting professional help costs money. And yes, there’s loads of information available online (you’re reading some of it right now). But inheritance tax planning is one area where DIY can be spectacularly expensive.

The rules interact in complex ways. Miss one detail and you can inadvertently trigger tax charges you never knew existed. Set up a trust incorrectly and you’ve created a tax liability rather than eliminated one. Make gifts without understanding the reservation of benefit rules and you’ve achieved precisely nothing.

I’ve seen people “save” a few hundred pounds on advice, only to cost their estate tens of thousands because they misunderstood a single rule. It’s like doing your own dental work because you don’t fancy paying for a dentist. Technically possible. Rarely advisable.

At Ask Accountant, we work with families to structure their affairs in ways that minimise the tax hit without you having to jump through ridiculous hoops or give up control of your assets. Based in Merton at 178 Merton High St, London SW19 1AY, we’ve helped countless London families navigate these exact challenges.

Whether it’s calculating your potential inheritance tax bill, structuring gifts properly, or setting up the right kind of trust for your circumstances, proper tax advisory pays for itself many times over. You can reach us on +44(0)20 8543 1991 if you want to discuss your specific situation.

The Bottom Line on Inheritance Tax

Here’s what you need to remember: inheritance tax isn’t some obscure levy that only affects the super-wealthy anymore. With thresholds frozen and asset values rising, more families are being caught every year. HMRC collected over £7.6 billion in 2024/25, and that’s set to keep climbing.

The real kicker? Most of it’s avoidable with proper planning. Not through dodgy offshore schemes or elaborate avoidance—just through understanding the rules and using them intelligently.

You’ve got allowances. Use them. You’ve got exemptions. Claim them. You’ve got planning opportunities. Take them. Because the alternative is your family writing a cheque to HMRC for 40% of everything above the thresholds when you’re gone—and nobody wants that legacy.

The families who end up paying the least inheritance tax aren’t necessarily the ones with the most sophisticated arrangements. They’re the ones who started planning early, kept proper records, and weren’t afraid to get professional advice when they needed it.

So where are you in all this? If you’re over the thresholds and haven’t done any planning, you’re basically volunteering your family for a significant tax bill. If you’ve done some planning but it was years ago, rules have likely changed enough to warrant a review.

And if you genuinely can’t afford to give anything away or make substantial changes right now? That’s fine. Start small. Use those annual exemptions. Make a proper will. Get your affairs organised so when you can do more, you’re ready.

The worst inheritance tax strategy is the one you never implement because you kept putting it off. The second worst is the one you do yourself without understanding the implications.

Your family’s financial future deserves better than both.

Frequently Asked Questions

Do I have to pay inheritance tax on my parents’ house?

It depends on the total value of their estate and whether they’ve used their allowances properly. If the house passes to you (a direct descendant) and the total estate is under £500,000 (£1 million for married couples), there’s usually no inheritance tax. Above those thresholds, you’ll pay 40% on the excess. The residence nil-rate band specifically exists to protect family homes being passed to children and grandchildren, but only up to £175,000 per person.

Can I give my house to my children to avoid inheritance tax?

Technically yes, but there are massive pitfalls. If you give your house away but continue living in it rent-free, it’s a “gift with reservation” and HMRC treats it as still part of your estate. If you want to gift the property and stay living there, you must pay market rent to your children—properly, with a tenancy agreement. And you still need to survive seven years for the gift to fall outside your estate. Many people think they’re being clever and end up creating a bigger mess than if they’d left things alone.

What happens if I die within seven years of making a gift?

The gift gets added back into your estate for inheritance tax calculations. If you die within three years, it’s taxed at the full 40%. Between three and seven years, taper relief reduces the rate on a sliding scale. However, taper relief only applies to the portion of gifts exceeding the nil-rate band (£325,000). If your total gifts plus remaining estate are under the threshold, there may be no tax anyway.

How much can I gift each year without paying tax?

You have an annual exemption of £3,000 which you can gift immediately tax-free. You can also give unlimited gifts of £250 to as many people as you want (but not £250 to someone who’s already receiving your £3,000). Wedding gifts have separate allowances (£5,000 to children, £2,500 to grandchildren, £1,000 to others). And if you can afford it, regular gifts from surplus income have no limit—but you need to document them meticulously.

Will my pension be subject to inheritance tax?

Currently, defined contribution pensions usually sit outside your estate for inheritance tax purposes, making them highly tax-efficient for passing on wealth. But from April 2027, this changes—inherited pensions will become liable for inheritance tax. If you die before 75, beneficiaries currently pay no tax at all. After 75, they pay income tax on withdrawals. Post-2027, we’re potentially looking at combined rates of up to 67% for those dying after 75 when you factor in both taxes.

Is inheritance tax different in Scotland and Wales?

No, inheritance tax is a UK-wide tax with the same rates and thresholds across England, Scotland, Wales, and Northern Ireland. However, the rules around property ownership and wills can differ slightly between jurisdictions, particularly in Scotland which has its own legal system. But the actual inheritance tax calculation remains identical throughout the UK.

Can I avoid inheritance tax by spending all my money before I die?

While you can certainly reduce your estate by spending money, most people want to leave something to their families. Plus, nobody knows exactly when they’ll die, so spending everything is risky—you might outlive your savings. Smarter strategies include making gifts within the exemption limits, using allowances properly, and planning with professional advice to minimise tax while maintaining your quality of life. Inheritance tax planning shouldn’t leave you impoverished.

What records should I keep for inheritance tax purposes?

Keep detailed records of all significant gifts made in the past seven years—dates, amounts, recipients, and the nature of each gift. Document regular gifts from income with bank statements and income records proving they’re affordable from surplus income. Keep property valuations, insurance policies, and investment statements. When you die, your executors will need this information to complete the IHT400 form. Missing records can lead to disputes with HMRC and potentially higher tax bills.